tax act stimulus check error

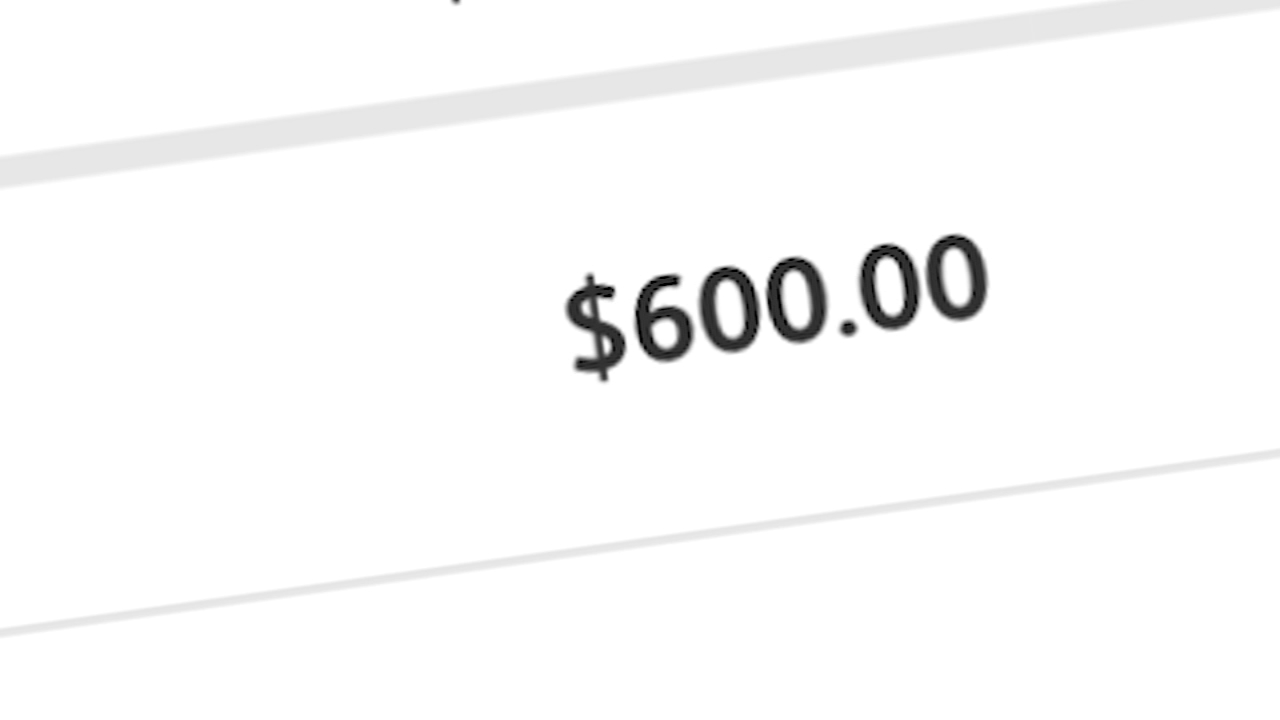

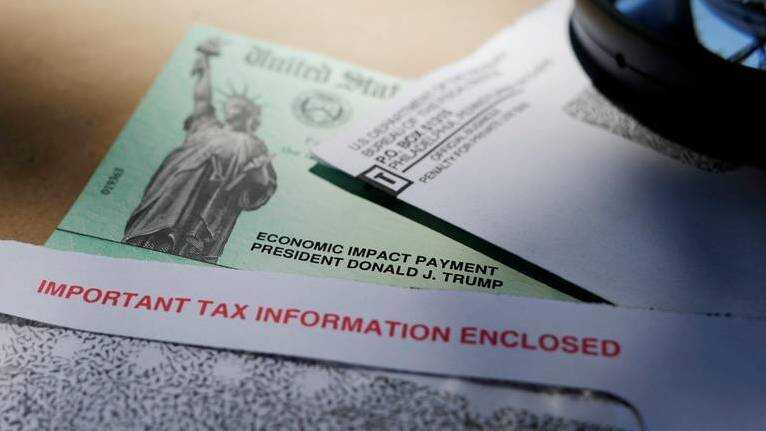

So far most American adults have received 3200 in direct stimulus payments 1200 from the CARES Act in March 2020 600 at the end of that year and then 1400 from the American Rescue Plan under the Biden administration in 2021. The enhanced child tax credit of 2021 is a one-time benefit payout to parents that is part of the federal governments relief funding delivered in response to COVID-19The child tax credit is available every year to parents but is typically only available to parents who pay taxes.

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York

If you did not receive the additional 1400 per qualifying in your third stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit on your 2021 tax return filed in 2022.

. If you are eligible for more stimulus money than you receive with the advance payment you may be able to claim the difference as a credit on your 2021 return that either decreases your tax liability or increases your refund. For this information refer to. 2021 Federal Tax Deadlines.

If the credit exceeded taxes owed taxpayers could receive up to 1400 as a tax. Credits Personal tax planning Dependents. The letter will help stimulus check recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022.

The IRS emphasizes that the information taxpayers see in the Get My Payment tool including account numbers and potential deposit dates may continue to display unfamiliar account numbers as the IRS continues to. The third stimulus check will not affect your 2020 tax return but it may help your 2021 tax return. IRS tax industry partners are taking steps to redirect stimulus payments to the correct taxpayer account for as many people as possible.

If youre eligible for less or received a stimulus check for the. Line 17 on Form 540. Had a California Adjusted Gross Income CA AGI of 1 to 75000 for the 2020 tax year.

That doesnt count payments for qualifying dependents or other stimulus money like expanded unemployment or advance. Filed your 2020 taxes by October 15 2021. However if your income increased in 2020 it may be in your best interest to wait to file your taxes until after your stimulus payment arrives.

But thanks to the Families First Coronavirus Response Act FFCRA and the Coronavirus Aid Relief and Economic Security CARES Act you might see some relief when you file your 2020 taxes taxes filed in 2021. Many Americans are feeling the impact of the COVID-19 pandemic on their everyday lives. Unfortunately because of an IRS error millions of payments were sent to the wrong accounts and some may not have received their stimulus payment TurboTax has since updated that it has emailed eligible customers to confirm when their stimulus payments were sent.

This payment is different than the Golden State Stimulus I GSS I. To estimate your stimulus payment visit our stimulus check calculator and for additional stimulus details and frequently asked questions visit the HR Block Coronavirus Resource Center. Government Benefits and Your Stimulus Payments.

Under the Protecting Americans from Tax Hikes PATH Act signed into law in December 2015 the IRS cannot issue refunds that include Earned Income Tax Credit EITC and Additional Child Tax Credit ACTC before mid-February. You got thisall you have to do is start. We break down the major changes that could impact your 2020 tax.

However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021. To qualify you must have. The letter will help stimulus check recipients determine if they are entitled to and should claim the recovery rebate credit on their 2021 tax returns when they file in 2022.

Two individuals in the same residence could receive a stimulus payment as long as they both qualify. COVID-19 Tax Relief for Student Loan Borrowers. The COVID-19 pandemic has left self-employed workers including freelancers and independent contractors unable to work or facing a significant drop in revenue.

Deceased individuals that use the marriedRDP filing status or have children may qualify for the stimulus payment. Delivery Timelines for Stimulus Payments. There are no rules in the American Rescue Plan Act that prohibit this.

A third round of dependent stimulus check payments has now been paid under the enacted 19 Trillion Biden COVID Relief Package American Rescue Plan Act ARPA. Fortunately the Families First Coronavirus Response Act FFCRA and the Coronavirus Aid Relief and Economic Security CARES Act offer some self-employed tax credits that can help. Had wages of 0 to.

The credit would decrease by 5 percent of adjusted gross income over 200000 for single parents 400000 for married couples. Line 16 on Form 540 2EZ. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information.

If your 2020 federal income tax return is on file by the time the IRS processes your stimulus check the amount of your payment will be calculated based on that reduced income. You can see all the eligibility rules for payment in this article. Find stimulus payment information and more.

The stimulus payment is issued per tax return not by householdresidence. We make filing taxes delightfully simple with our flatrate. You can no longer use the Get My Payment application to check your payment status.

The tax preparation software company posted via Twitter on January 6 2021 that. Check if you qualify for the Golden State Stimulus II. Most eligible people already received their Economic Impact Payments.

Under those rules which were established by 2017s Tax Cuts and Jobs Act TCJA taxpayers could claim a CTC of up to 2000 for each child under age 17. Tax Day has been delayed this year but if youre one of the millions of people missing stimulus check money from the first two payments nows the time to file for a Recovery Rebate Credit on. While the stimulus checks and now-expired Child Tax Credit provided direct aid to families most federal aid programs miss the mark and only reach a fraction of the intended recipients noted.

Get More Stimulus Money Using IRS Letter 6475 Find. The PATH Act which applies to all tax preparation methods is intended to help detect and prevent tax fraud. The payment is not available for deceased individuals.

Child Support Debt and Your Stimulus Payments. The latest amount in this round of payments is 1400 for each dependent the same as the adult stimulus payment.

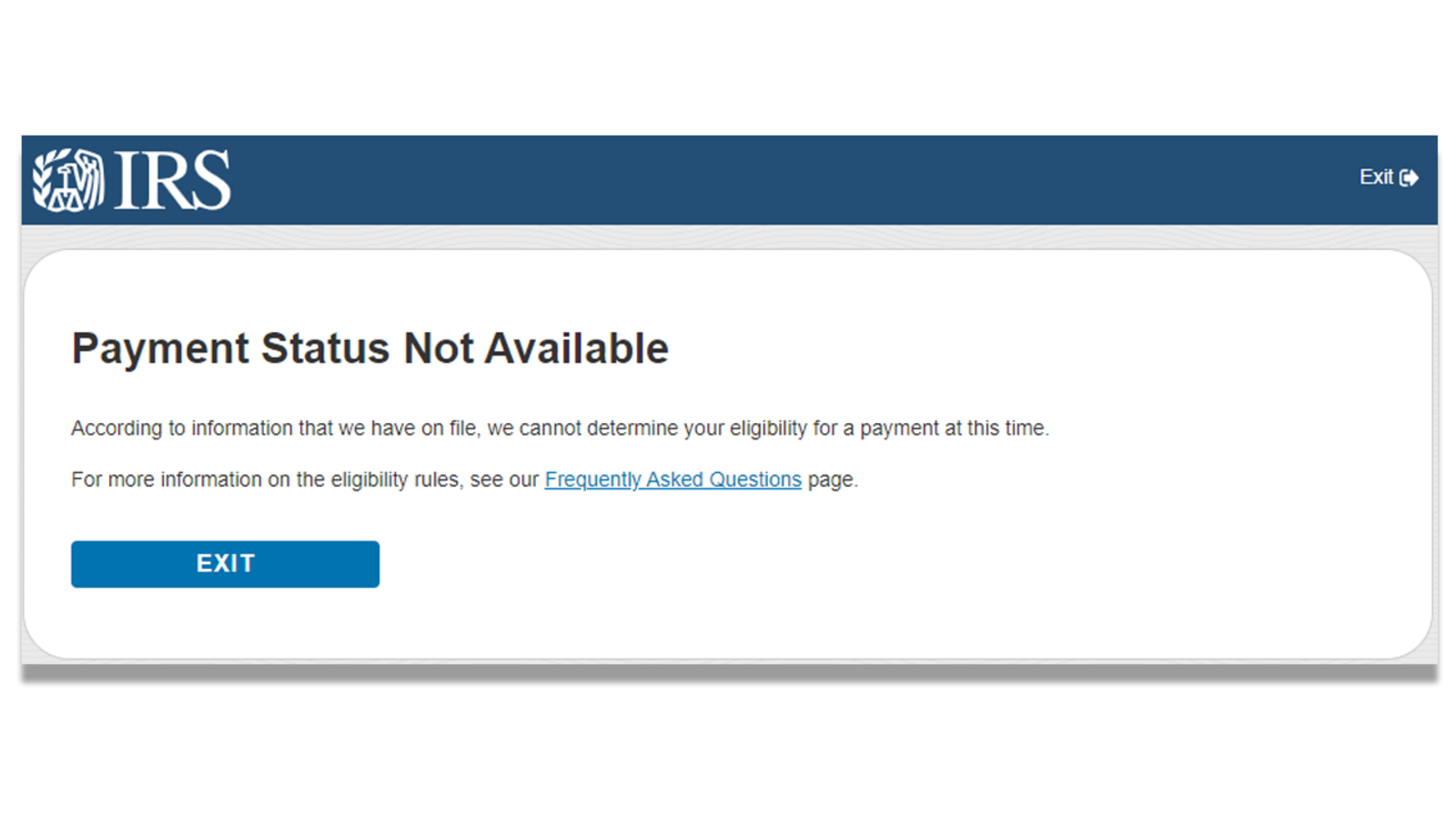

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc13 Houston

Third Stimulus Check Update How To Track 1 400 Payment Status 11alive Com

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 San Francisco

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Important Updates On The Second Stimulus Checks Taxact Blog

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Need To Know How Those Who Didn T File Taxes Can Get A Stimulus Check Cbs19 Tv

3rd Stimulus Checks Here S What To Know As Irs Starts Sending Out 1 400 Payments Wgn Tv

Third Stimulus Check Social Security Payments Going Out Friday Cbs19 Tv

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Nonresident Guide To Cares Act Stimulus Checks

Stimulus Check Payments Nursing Home Residents Center For Elder Law Justice

Important Updates On The Second Stimulus Checks Taxact Blog

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

Never Got A Second Stimulus Payment Here S What To Do Next And Other Faqs Forbes Advisor

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham